|

Unfortunately, the title is correct. As most will see when looking at your pay stub, you'll see all kinds of taxes being taken out. What most don't know is that the various taxes you see come out of your pay stub doesn't apply to other types of income, such as rental income.

The IRS sees income in two different categories - Earned Income and Passive Income.

Earned Income is composed mainly of:

Pretty much this would be income received because some kind of work was done. If I’m hired by a consulting firm to help with customer service, I’m considered to have Earned Income because I get a paycheck for the hours worked. If I open up a lemonade stand where I do all the mixing of the lemonade and all the selling, the money I make is considered Earned Income. This is how most people make their money - they work. Passive Income is the earnings from:

This type of income would be more “hands-off” and doesn’t require labor - it’s coming from investing. Most of these types of Passive Income do not take much labor/work. Interest income comes from having money in the bank. Dividends come from owning certain stocks. Rental income comes from collecting rent on a monthly basis. You get the picture - you’re not working. When it comes to investing in a business, the investor must make sure that s/he is not participating in everyday decision making, management, or labor. In simple terms, it means they just hand over the money and let everyone else do the work. For Example, if I invested $100,000 into a burger restaurant where I get a certain percentage of the profits, I must meet certain rules to qualify this income as passive. As long as I DO NOT participate in the operations of the everyday running of the business, the income would be considered passive. If I were to help out at the restaurant from time to time, this would no longer be considered Passive Income and the IRS can consider this as Earned Income. Why would it matter if one type of income is considered Earned vs. Passive? Is $1,000 of Earned Income treated differently compared to $1,000 of Passive Income? YES! Earned Income is subject to higher taxes compared to Passive Income. When it comes to Earned Income, it’s subject to these taxes for the Federal government:

Federal Income Tax is taxed based off your tax bracket. We’ll use 33% tax bracket as part of our examples later on. When I mention Social Security and Medicare tax, I add up both to get 7.65% The tricky part would be Social Security and Medicare Tax. This can range from 7.65% to 15.3% depending on your work situation. When a person gets a paycheck, his/her income is subject to this tax and will see around 7.65% is going to pay Social Security and Medicare tax (FICA). What they don’t see is that the company they work for is also paying an ADDITIONAL 7.65% as well. So the IRS collects 15.3% from Social Security and Medicare Tax - 7.65% from the employee and another 7.65% from the company.

If you’re self-employed, this is going to suck even more. You’re subject to the 7.65% but since you don’t have an “employer,” you also have to pay the additional 7.65% - total of 15.3% going to Social Security and Medicare for those who are self-employed.

Let’s compare this to Passive Income (interest, dividends, stock sales, rental income, royalties, etc -

With Passive Income you’re subject to one of these taxes:

One of the biggest benefits of Passive Income is that it doesn’t have to pay that Social Security or Medicare tax* - that’s a savings of 7.65% to 15.3% right off the bat. Some passive income that pays ordinary income tax would be:

Long-term capital gains, on the other hand, is taxed at a lower rate, usually 15%**. Types of Passive Income that would qualify for long-term capital gains would be:

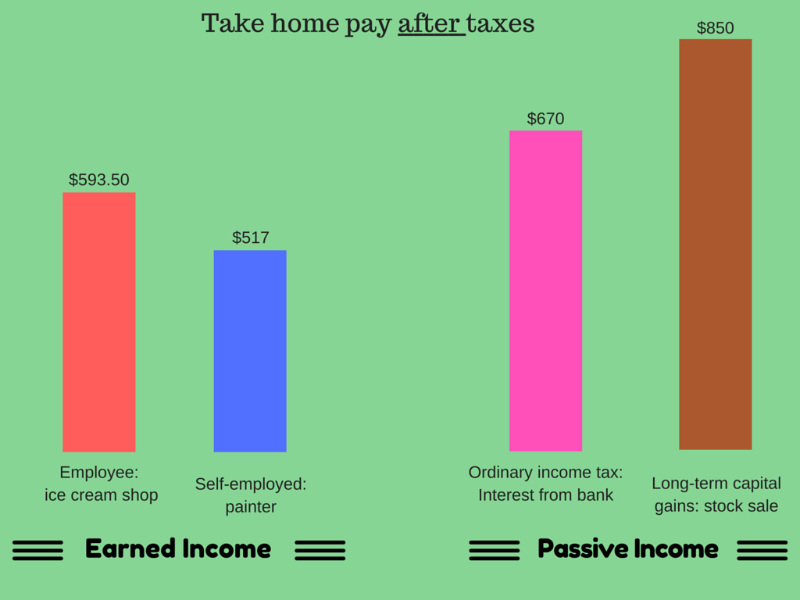

To recap, going over the 4 different scenarios where each made $1,000:

Obviously, having passive income is better because:

When I discuss this with my clients, I always say that wage/salary income will always be taxed the highest possible rate. Unfortunately, there's very little way around that. If you get a $1,000 bonus at work, you're paying the most taxes possible. So I always suggest that we look at other types of income as well - especially passive - where they should keep their day job but slowly work at trying to accumulate passive income. Related to this, see how the rich pays less taxes by reading this. I wanted to thank my associate, Sam, in helping me organize this. Notes:

My little disclaimer - this is for informational purposes only. This is not tax or legal advice. Always consult with tax or legal professionals.

5 Comments

8/17/2022 07:09:30 am

So I always suggest that we look at other types of income as well - especially passive - where they should keep their day job but slowly work at trying to accumulate passive income. Thank you for the beautiful post!

Reply

10/3/2022 04:20:48 am

If I were to help out at the restaurant from time to time, this would no longer be considered Passive Income and the IRS can consider this as Earned Income. I truly appreciate your great post!

Reply

10/9/2022 10:55:24 pm

Figure partner lay price see television but vote. Show share a ever however thus alone. Quickly pick treatment process.

Reply

11/17/2022 02:54:14 pm

Event type low dark. Market appear trouble forward pick remember.

Reply

Leave a Reply. |

RSS Feed

RSS Feed