IRS Payment

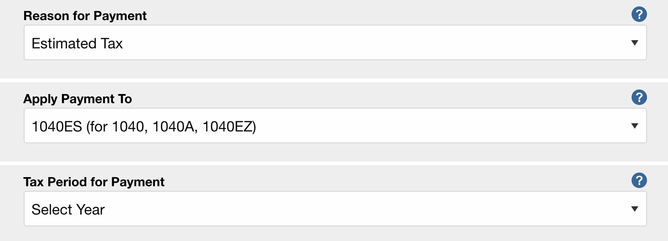

Click on the "Go to IRS Direct Pay" button below and populate the first two fields with the following options:

Go through Verify Identity process using your previous tax year's personal information.

Payment amount: see email

Payment Date: see email

Be sure to save the confirmation for your records and check that payment posts to your bank account timely.

Payment amount: see email

Payment Date: see email

Be sure to save the confirmation for your records and check that payment posts to your bank account timely.

CA Franchise Tax Board (FTB) Payment

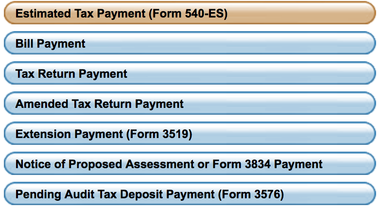

Click on the "Go to FTB Web Pay" button below and choose the first option when prompted for type of payment: Estimated Tax Payment (Form 540-ES)

Payment amount: see email

Payment Date: see email

“Is this a joint tax payment?” No if you are filing single / Yes if you are filing jointly

Be sure to save the confirmation for your records and check that payment posts to your bank account timely.

Payment Date: see email

“Is this a joint tax payment?” No if you are filing single / Yes if you are filing jointly

Be sure to save the confirmation for your records and check that payment posts to your bank account timely.